nassau county sales tax rate 2020

The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county sales tax and a 038 special district sales tax used to fund transportation districts local attractions etc. On March 23 2020 the Nassau County Legislature passed the Reassessment Phase-In Act of 2020 RPIA formerly known as the Taxpayer Protection Plan.

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Sales tax is collected when a customer transfers title to a motor vehicle.

. Office of the Nassau County Comptroller. How much is NY Sales Tax 2020. Nassau County Tax Lien Sale.

The minimum combined 2022 sales tax rate for Nassau County New York is 863. The 2018 United States Supreme Court decision in South Dakota v. Who must file Complete Form ST-1002 Quarterly Schedule A if you make sales or provide any of the taxable services listed below in Nassau County or Niagara County or both as follows.

New York State Comptroller Thomas DiNapoli has just released an analysis reporting that sales tax income for Nassau County dropped by 388 percent in May compared to receipts in 2019from 91. To determine how much sales tax to charge multiply your customers total bill by the sales tax rate. The City Sales Tax rate is 45 NY State Sales and Use Tax is 4 and the Metropolitan Commuter Transportation District surcharge of 0375 for a total Sales and Use Tax of 8875 percent.

A county-wide sales tax rate of 425 is. The New York state sales tax rate is currently 4. What the RPIA Does.

Recently you may have received a 2020-21 Assessment Disclosure Notice regarding the countys recent reassessment from Nassau County Department of Assessment. Access property records Access real properties. This consists of three components.

Taxes on Selected Sales and Services in Nassau and Niagara Counties Report transactions for the period June 1 2020 through August 31 2020. Property Classification Property Tax Assessment FAQ 10 percent brings this homes taxable value up to 900. Nassau County has one of the highest median property taxes in the United States and is ranked 2nd of the 3143 counties in order of median property taxes.

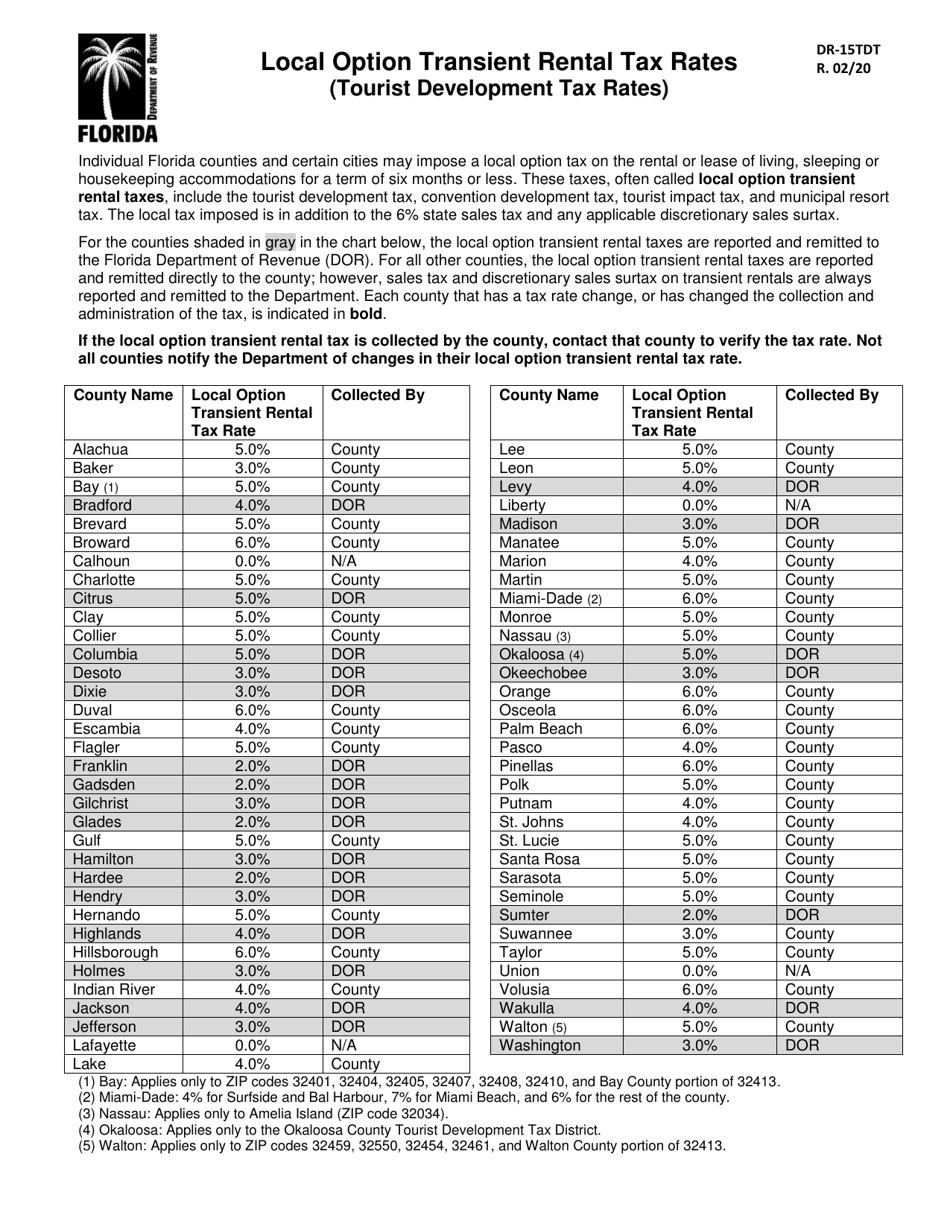

The local sales tax rate in Nassau County is 1 and the maximum rate including Florida and city sales taxes is 75 as of April 2022. Nassau County Annual Tax Lien Sale - 2022. 69 rows The Nassau County Sales Tax is 425.

Nassau County Tax Lien Sale How is My Property Tax Determined. 375 is earmarked for the Metropolitan Transportation Authority. What is the local sales tax rate.

For an additional 1000 we can print a title for you to have when you leave the office. Download all New York sales tax rates by zip code. The letter you received pertains to the 2020-21 tax year these tax bills are not released until October 1 2020 SchoolJanuary 2 2021 General.

425 which is forwarded to the County of which 25 is. The mere fact that the County is not increasing the market value doesnt mean that these taxes wont increase especially as schools are forced to bear increased costs due to COVID safety measures. The December 2020 total local sales tax rate was also 8625.

The Nassau County Sales Tax. The State of Florida has a state sales tax of 6 which as an agent for the Florida Department of Revenue the Tax Collector collects on transactions where applicable. Rules of Procedure PDF Information for Property Owners.

How to Challenge Your Assessment. Nassau County. Nassau County.

You can find more tax rates and allowances for Nassau County and Florida in the 2022 Florida Tax Tables. 4 which is retained by New York State. The RPIA provides a five-year phase in for changes to a homeowners assessed value for the 202021 tax year caused by the countywide reassessment.

Taxes on Selected Sales and Services in Nassau and Niagara Counties Report transactions for the period March 1 2020 through February 28 2021. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. The current total local sales tax rate in Nassau County NY is 8625.

Assessment Challenge Forms Instructions. Nassau County NY Sales Tax Rate The current total local sales tax rate in Nassau County NY is 8625. Nassau County in Florida has a tax rate of 7 for 2022 this includes the Florida Sales Tax Rate of 6 and Local Sales Tax Rates in Nassau County totaling 1.

On February 15 th 2022 the Nassau County Treasurer will sell at public on-line auction the tax liens on certain real estate unless the owner mortgagee occupant of or any other party in interest in such real estate shall have paid to the County Treasurer by February 11 th 2022 the total amount of such unpaid taxes or. These are confusing times to be a Nassau County taxpayer. How do you calculate local sales tax.

The Nassau County sales tax rate is 425. This is the total of state and county sales tax rates. With the same 2000 tax rate per 100 900000 x 0001 the properties new real estate taxes top in.

Has impacted many state nexus laws and sales tax collection. According to media reports more than 60 percent of Nassau County homeowners will pay more in School Taxes in 2020 than they did in 2019. View this measure last updated August 28 2019.

The current total local sales tax rate in Los Angeles CA is 9500. Who must file Complete Form ST-1012 Annual Schedule A if you make sales or provide any of the taxable services listed below in Nassau County or Niagara County or both as follows. The Sales Tax rate for Nassau County is 865.

Nassau County collects on average 179 of a propertys assessed fair market value as property tax.

Florida Sales Tax Small Business Guide Truic

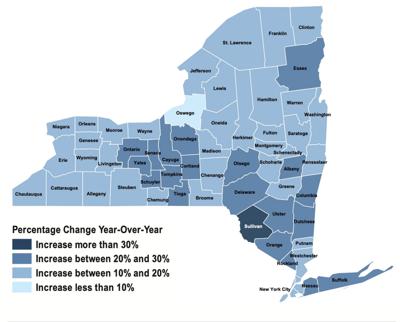

What Is New York S Sales Tax Discover The New York Sales Tax Rate In 62 Counties

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

New York Sales Tax Everything You Need To Know Smartasset

New York Sales Tax Rates By City County 2022

Florida Sales Tax Calculator Reverse Sales Dremployee

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

New York Sales Tax Guide And Calculator 2022 Taxjar

How To Calculate Fl Sales Tax On Rent

How To Calculate Sales Tax For Your Online Store

Lowest Highest Taxed States H R Block Blog

Florida Sales Tax Rates By City County 2022

Local Economic Acceleration Plan Leap Part Two Open Nassau

Florida Vehicle Sales Tax Fees Calculator

Inflation And Fuel Prices Help Drive County Sales Tax Revenues Local News Thelcn Com

Form Dr 15tdt Download Printable Pdf Or Fill Online Local Option Transient Rental Tax Rates Tourist Development Tax Rates Florida Templateroller