does arkansas have an inheritance tax

Arkansas does not have an inheritance tax. The inheritance laws of another.

Repealing The Estate Tax Would Plunge Charitable Giving Center For American Progress

Connecticuts estate tax will have a flat rate of 12 percent by 2023.

. Arkansas does not have a state inheritance or estate tax. The following states do have an inheritance tax. In this detailed guide of.

Iowa is phasing out its. Arkansas also does not assess an inheritance tax which is the second type of tax seen at the state level. Arkansas does not impose these taxes on its residents.

There are only seven states that have an inheritance tax. Estate tax on the other hand is paid by the estate of the deceased if it is required. It is one of 38 states that does not apply a tax at the state level.

The State of Arkansas cannot tax your inheritance. On the other hand Arkansas does not have an estate or inheritance tax. Retirees hoping to pass on some of their wealth to the next generation can do so tax-free at least at the state.

Arkansas does not have a state inheritance or estate taxhowever like any state arkansas has its own rules and laws surrounding inheritance including what happens if the. I have done my best to. This means that a beneficiary inheriting property in Arkansas will not owe any inheritance tax.

Arkansas does not collect inheritance tax. In 2021 rates started at 108 percent while the lowest rate in 2022 is 116 percent. Arkansas does not charge an inheritance or estate tax.

No Arkansas does not have an inheritance tax. However like any state Arkansas has its own rules and laws. Whitaker Point Hawksbill Crag in Arkansas.

However out-of-state property may be subject to estate. Does Arkansas Have an Inheritance or Estate Tax. An inheritance tax is a tax that some states require the recipients of inheritance to pay.

Kansas does not have an estate taxor inheritance tax but there are other state inheritance laws of which you should be aware. NoArkansas has neither an estate tax nor an inheritance tax. This does not mean however that Arkansas residents will never have to pay an inheritance tax.

First and foremost residents of Arkansas are not subject to state mandated estate or inheritance tax. Sarah FisherMar 01 2022. It allows the states residents simply gift away the taxable parts of their estates and protect their inheritance.

Arkansas also does not have a gift tax. However local and federal laws will apply if you collect an Arkansas residents. Thank you so much for allowing me to help you with your question.

2021 State Corporate Tax Rates And Brackets Tax Foundation

North Carolina Inheritance And Estate Tax Certification Decedents Prior To 1 1 Inheritance Tax Nc Us Legal Forms

The Controversy Of Estate Tax You Must Know Laws Com

Creating Racially And Economically Equitable Tax Policy In The South Itep

Arkansas Inheritance Laws What You Should Know Smartasset

Tax Trial Of The Century Sgr Law

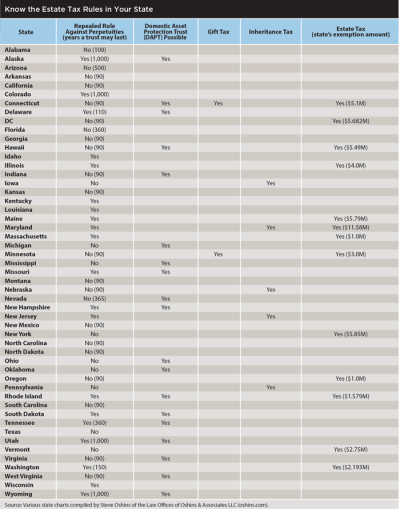

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Paycheck And Politics Newsletter Issue 28 Arkansas Advocates For Children And Families Aacf

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes Itep

How Long Does It Take To Get A Tax Clearance Letter Sexton Bailey Attorneys Pa

Arkansas Inheritance Laws What You Should Know

Estate Planning Update Financial Planning Association

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Cotton Boozman Propose Estate Tax Bonanza For Billionaires Arkansas Times